What is Financial Technology (Fintech)?

FinTech (financial technology) is an umbrella term for software, mobile applications and other technologies created to improve and automate traditional forms of finance for both businesses and consumers. FinTech can include everything from simple mobile payment apps to complex blockchain networks containing encrypted transactions.

Definition of Fintech

The term “fintech company” refers to a company that uses technology to modify, enhance, or automate a business or consumer financial service. Examples include trading platforms such as mobile banking, peer-to-peer payment services (Venmo, CashApp, etc.), automated portfolio managers (Wealthfront, Betterment, etc.), Robinhood, etc. It can also be applied to the development and trading of cryptocurrencies (Bitcoin, Dogecoin, Ethereum, etc.).

A Brief History of Fintech

FinTech may look like a series of new innovations, but the basic concept has been around for some time. Credit cards in the early 1950s represented the first FinTech products generally available, as consumers no longer have to carry physical currency with them in their daily lives. From there, FinTech has evolved into a banking mainframe and online stock trading service.

Founded in 1998, PayPal was one of the first fintech companies to operate primarily on the Internet. This is a breakthrough company that has revolutionized further with mobile technology, social media and data encryption. This fintech revolution has brought about the mobile payment apps, blockchain networks and social media payment options that we regularly use today.

How Does Fintech Work?

FinTech is a multifaceted concept, but it can be very well understood. FinTech simplifies consumer and corporate financial transactions, making them more accessible and generally affordable. It can also be applied to businesses and services that use AI, big data, and encrypted blockchain technology to enable secure transactions within their internal networks.

Broadly speaking, FinTech strives to streamline the transaction process and eliminate steps that are potentially unnecessary for all involved parties. For example, mobile services such as Venmo and CashApp allow you to pay others and send funds directly to your bank account at any time of the day. However, if you pay by cash or check instead, the recipient will have to go to the bank to deposit the money.

Fintech Trends for 2022

Over the years, FinTech has grown and changed in response to development within the broader technology sector. In 2022, this growth will be driven by some dominant trends.

Digital banking continues to grow

Digital banking is more accessible than ever. Many consumers already manage their money, apply for and repay loans, and buy insurance through digital-first banks. This simplicity and convenience could drive further growth in this sector, and the global digital banking platform market is expected to grow at a compound annual growth rate (CAGR) of 11.5% by 2026.

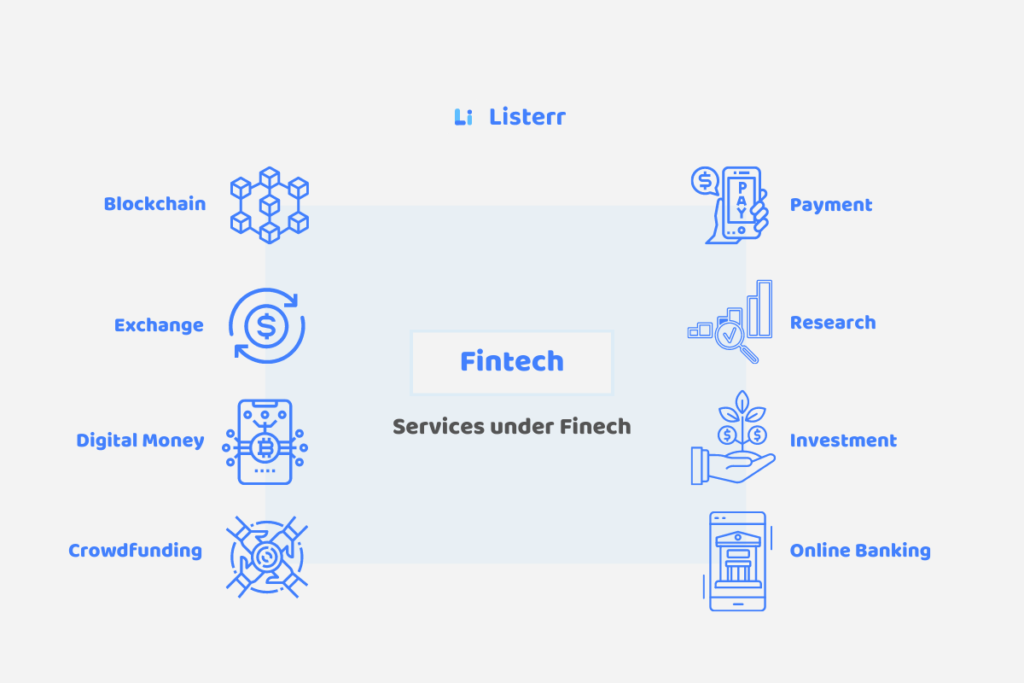

Blockchain

Blockchain technology enables decentralized transactions without the involvement of government agencies or other third-party organizations. Blockchain technology and

applications have grown rapidly over the years and are expected to continue in 2022 as more industries turn to advanced data encryption. See our blockchain technology guide for more information.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies have transformed the way fintech companies extend and redefine the services they provide to their customers.

AI and ML can reduce operational costs, increase customer value, and detect fraud. As these technologies become more affordable and accessible, they will play a greater role than ever in the continued evolution of FinTech, especially as more retail banks digitize. You can expect that.

Crowdfunding

Crowdfunding platforms allow Internet and app users to send and receive money to and from other users on the platform, allowing individuals and businesses to collect funds

from a variety of sources in one place can do. Companies like Kickstarter and GoFundMe have allowed startups to skip the traditional banking path for business loans and go directly to investors.

Insurance

Insurtech i.e, Insurance Technology has transformed the way consumers buy and use insurance. Thanks to the technology, insurance premiums are calculated automatically. Products such as telematics (black box) are currently being offered to young and inexperienced drivers, which can reduce car insurance premiums.

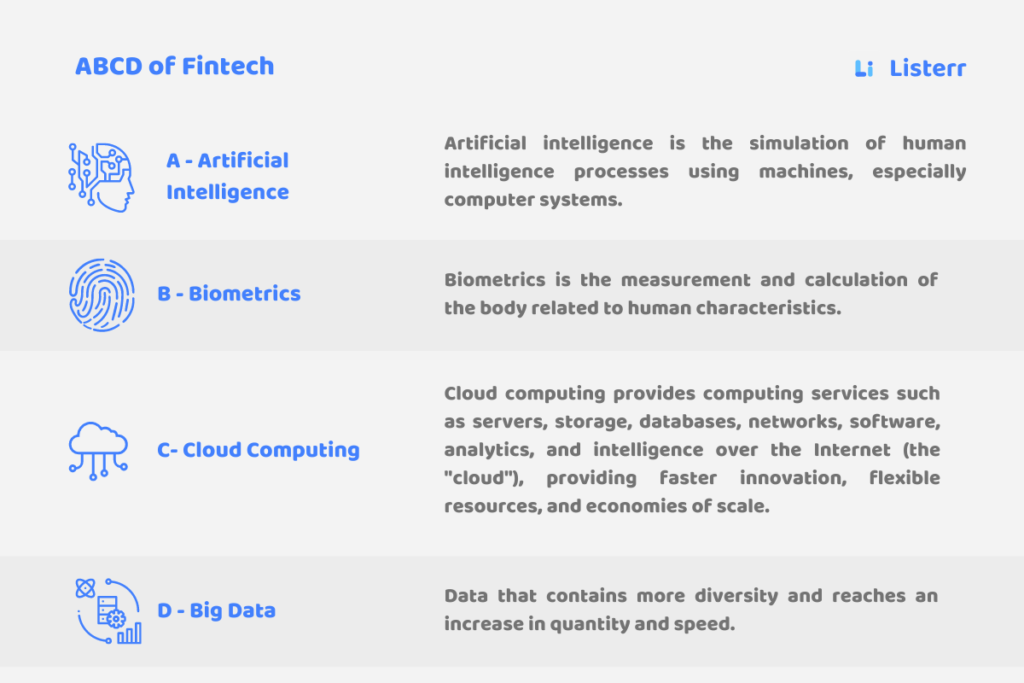

The Technologies That Power Fintech

Today’s FinTech primarily leverages AI, big data, cloud computing and blockchain technology, all of which completely redefine how businesses transfer, store, and protect their digital currencies.

In particular, AI provides valuable insights into consumer behavior and corporate spending habits to help customers better understand. Big data analytics help companies anticipate market changes and create new data-driven business strategies. Blockchain, a new financial technology, enables decentralized transactions without third-party input. Leverage the blockchain participant’s network to monitor the potential for changes or additions to encrypted data.

How Safe is Fintech?

FinTech companies are generally trusted by consumers-According to Forbes, 68% are willing to use financial products developed by non-traditional (eg, non-financial, non-banking) institutions. .. However, many fintech applications are relatively new and are not currently subject to the same security regulations as banks. This does not mean that consumers should not trust fintech companies with their own money. That means that attention can be beneficial. For most consumers, the benefits of working with fintech companies outweigh the perceived risks.

The Future of Fintech

It is a well-known fact that the fintech industry has skyrocketed in the last decade, with the proportion of funds invested in fintech increasing from 5% to nearly 20%. Non-digitized financial institutions struggle to survive in a highly competitive environment. Technology, machine learning, and artificial intelligence dominate the way businesses work.

What comes next is unpredictable, but anything is possible in the ever-evolving global fintech industry.