Why Embedded Finance is the next big thing?

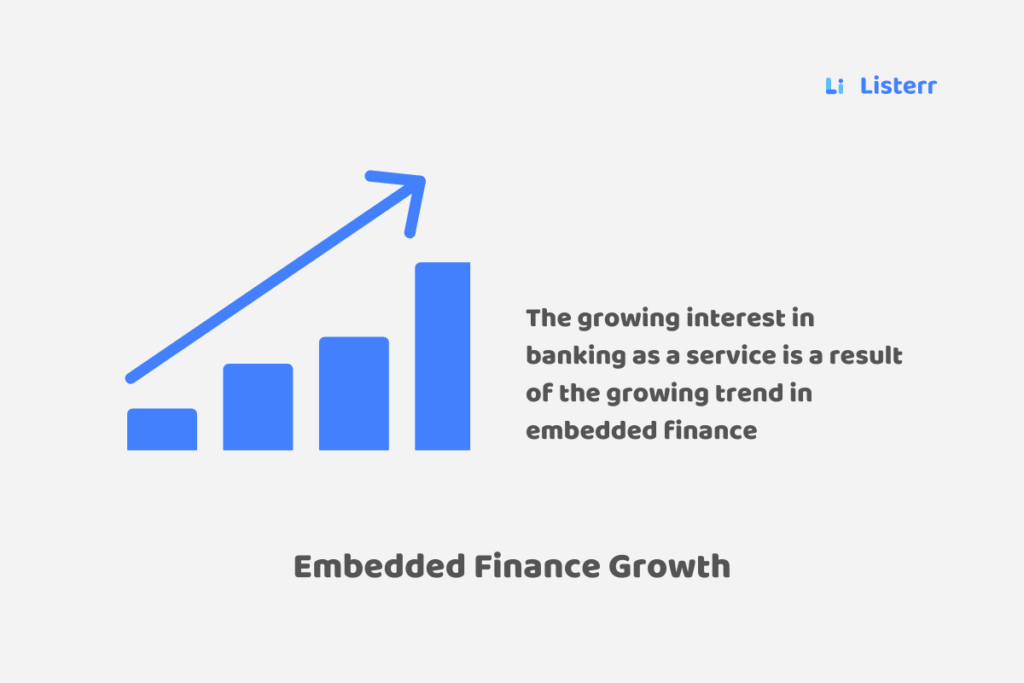

Oracle predicts that the value of embedded financial markets will exceed $ 7 trillion over the next decade. This is twice the total value of the 30 largest banks in the world today.

Markets that are rapidly becoming a competitive battlefield already have viable market opportunities.

B2B e-commerce, which has become a buzzword in consumer finance in recent years, is because many start-ups offer companies built-in services such as buy now, postpay (BNPL), and trade credit insurance. Now, it’s a hot topic.

If you’re new to it, it’s time to find out why embedded finance is the next big thing.

What is embedded finance?

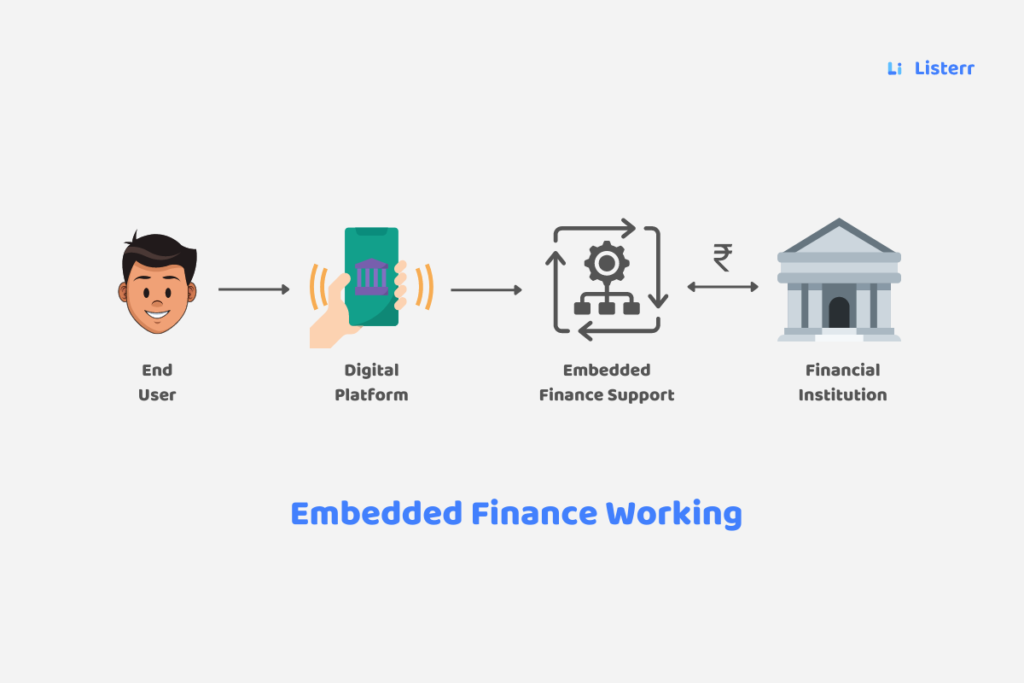

Simply put, embedded finance is the integration of financial services or tools traditionally sourced through banks into the products or services of non-financial organizations.

Consider an online store that offers short-term loans in the form of BNPL, or a digital wallet on your mobile phone that enables instant contactless payments. But this is just the beginning.

Embedded finance is beginning to streamline financial processes in both consumer and business transactions by reducing barriers to entry for a variety of products and services.

In the past, consumers may have to go to a real bank to get credit for a large purchase, or business buyers have hours of tedious paperwork to access trade credits. May spend. Currently, these services are easily available at the time of purchase.

Embedded finance examples

Let’s take a look at some of the most advanced areas of embedded finance.

Embedded payments

Embedded payments make life easier for consumers and business buyers by enabling instant payments at the touch of a button.

An example of this is the integration of payment technology into the infrastructure of apps and e-commerce websites. This eliminates the need for the buyer to enter credit card details for each transaction. Ride-sharing apps like Uber use embedded payments, so customers don’t have to withdraw their credit cards or look for cash, but the app pays automatically when the ride is complete.

Digital wallets, which enable contactless mobile transactions and instant online purchases, are another form of embedded payment that has become very popular since the launch of Apple Pay in 2014.

Embedded lending

Here, credit or financial products are integrated with non-financial services businesses such as retailers and markets, basically giving buyers access to postpaid options at the time of sale without having to go to a bank or other lender.

The embedded lending business, commonly referred to as BNPL, is well known thanks to the widespread and successful success of major companies such as Klarna and Clearpay in embedded finance for consumers. However, the B2B BNPL market is growing rapidly, giving companies access to an enhanced digital version of traditional trade credit, eliminating the need for tedious paperwork and long waits for approval.

Embedded insurance

In the past, buyers who wanted to guarantee new purchases had to go through the painstaking process of finding and securing the best insurance products they could find. He /she invested after spending time, money and effort investigating and purchasing products first time.

Now you can find insurance products when you need them and add them to your purchase with a single click, eliminating the need to contact brokers and insurance agents and virtually screen out the options of different insurance companies. A classic example of embedded insurance can be found in the travel sector, where travel insurance is provided every time you buy a plane or train ticket.

Looking ahead

Obviously, embedded finance has the flexibility and universality to apply to any business or industry that has a transactional element. It also has the potential and momentum to

completely revolutionize payments and broaden the horizons of innovation in the financial services sector. Even established players who are traditionally slow to embrace new practices are beginning to see the world of opportunities offered by embedded finance.

Legacy systems and processes are not designed to make the real-time decisions needed to sell embedded financial products. It is possible for banks and insurers to move to a new technology stack, but that is one difficult and dangerous venture. Instead, many have chosen to partner with agile technology start-ups to achieve this goal.

Embedded finance requires a “paradigm shift” in thinking. Financial instruments, along with the underlying sales, are no longer the most important thing buyers have been looking for in the first place. For example, consumers would go to the British Airways website to buy a flight instead of buying travel insurance, but would buy both. Most banks and insurers have distribution networks, the reason for which they exist is to push products, but embedded finance relies on a “pull” logic to pull out financial products when consumers need them.

As a result, embedded finance requires vendors to look at their financial products through a technical lens. It is a digital product that combines the underlying financial product with

the API and makes it available to partners. Traditional banks and insurers cannot build, document, or promote ecosystem APIs. They are not yet aware that the “API” is as important as a contract, and that it actually has two customers. The first customer is the developer or partner responsible for embedding the product, and the second customer is the end user to take out the product.